Digital Currency has arrived in many countries, including India in pockets, but major economies are still toying with the idea of how to bring it under currency regulations. The idea of Bitcoin was to be completely decentralized without any moderating platform. It was supposed to be a cryptocurrency and supposed… read more →

Cut to 2015. The scenario is lot more encouraging. Economic times of India, in an August feature indicates that albeit being slow, there are many Indians who have started using bitcoin to transfer money to the kin abroad. In a report, Red Herring reports that the usage of bitcoin in… read more →

India has taken a cautious approach to Digital Currency. The journey is one of that of cautious rejection and the Reserve Bank of India has a strong position against evolution of digital currency without proper security and legal systems to support. RBI advisory and raids: In a conference in… read more →

New evolutions like Digital Currency and mobile banking have challenges conventional ways of dealing with cybersecurity. Traditionally, closed ecosystems have been advocated for design of ‘commercial transactional architecture’ systems – which enable to predict threats and easier way of risk management overall. But as Banking 2.0 explains, the consumer behaviour… read more →

In continuation of our earlier blog, we analyse the confluence of mobile banking and digital currency in this piece. Bill Gates in his 2015 annual letter talks about Digital Banking being one of the most important disruptions of the 21st century. Already with developing countries, mobile phones are becoming banks… read more →

In our earlier blog, we had explored the various uses of blockchain as a ‘relational database’. We shall explore a specific use case in this blog – Banking 2.0 Banking 2.0 is a new concept promoted by Brett King. He talks about how consumer behaviour is the seed for innovation… read more →

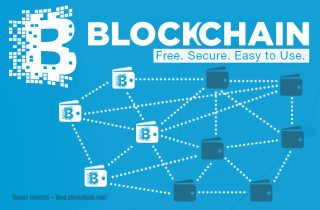

In the earlier blog ‘Digital Economy – Bitcoin: The BlockChain Story’ is making waves as a much needed encryption mechanism for databases. There have been waves of security attacks, as more and more people switch to online transactions. Ecommerce, online services transactions and citizen services (by governments) have made life… read more →

In the last blog, we covered how digital economy is about to be influenced by block chain startups. Now, let us look at some of the BlockChain Applications. Look at it this way – we are seeing both government, monetary authority and central banks starting their own digital currency initiatives. … read more →

BlockChain, the underlying technology of Bitcoin is becoming a strong method for secure payments. Blockchain refers to the public ledger of transactions in bitcoin. These transactions are verified and updated by a network of computers solving complex algorithms in order to add a new block to the code.With that, the… read more →

After exploring the near-, mid-, and long terms measures of cyber security with respect to digital economy, we shall now explore another aspect of digital economy. While not still prevalent in the main stream, especially in the fast growing ecommerce industry in the world, digital currencies have made a significant… read more →